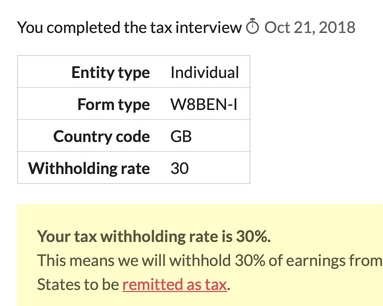

Mine has been like this since …2018!

For four years I wasn’t selling much at all, so I just used PayPal since they only take 25% rather than 30%.

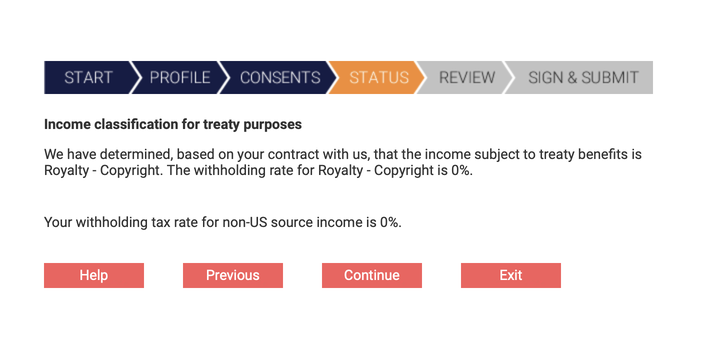

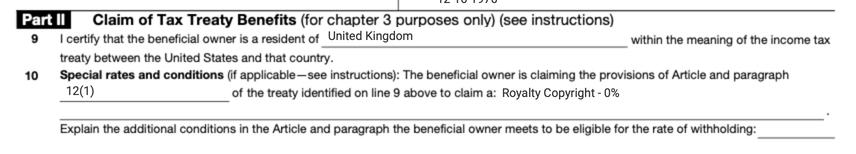

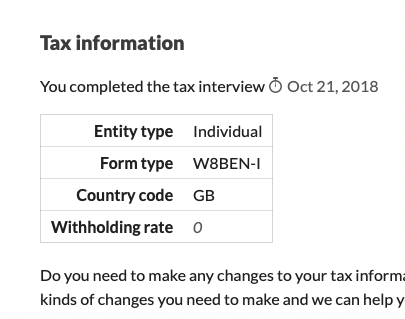

But since April 2022 I’ve begun to sell many games so I really need to sort this out. I’m losing a lot of money.

I sent an email to support with screenshots. I’ve had confirmation that the issue has been received and reviewed, but so far there’s been no reply or resolution.