Gross revenue is the total net sales you have accumulated for that project. Note that if you make a withdrawal, gross revenue is not reset.

Available balance is an estimate of the money you will actually receive after all applicable deductions.

Deductions can be divided into three parts: the transaction fee charged by PayPal or Stripe, which is usually around $0.50 USD plus 3% of each transaction

Itch percentage, which is 10% by default.

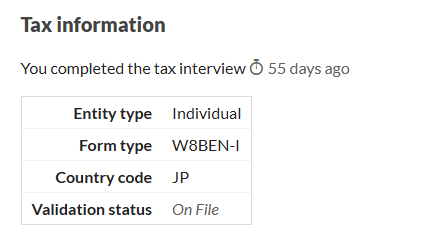

Withholding tax: If you haven't made any withdrawals yet, your tax interview hasn't been validated, and the ESTIMATE balance is calculated using a 30% withholding tax on all your sales.

When you request a withdrawal, Itch will validate your interview and calculate the final withholding tax based on your country of residence. This final withholding tax only applies to sales originating from the USA, and this calculation is only done when you request a withdrawal.

Note: Validating your tax interview costs $3, which will be deducted from your first withdrawal.

Example for ESTIMATE balance:

12 - (0.5 + 12*3% PAYMENT FEE) -12*30% WITHHOLDING TAX - 12*0% ITCH REVENUE = 7.54 per sale * 7 sales = 52.78 approximate

How much do you actually receive?

It will depend on your country of residence and the countries of your buyers. The estimate Itch uses for available balance is the worst-case scenario, where you live in a country that doesn't have a tax treaty with the USA and all your sales were made from the USA.

In the best-case scenario, your withholding tax is 0%, so you only need to deduct the payment fee