Day 4, a day!

I ended up being able to implement quite a few things last night and today!

Last night after getting the text validation working, I started working on buttons and non-fillable forms!

So now we have 3 papers that you can switch between The fillable form 1040, the W2 form (that will change per character and be swapped with form 1099s), and the tax table!

Since I do partially want this game to be educational I feel i should explain these forms a bit here in my devlog, feel free to skip this paragraph. The form 1040 is what American taxpayers technically file to the IRS. Most don't actually fill it out while looking at the 108 page instructions. If you've paid taxes through a service like turbo tax, they fill out a digital version of this form for you and file it as a tax preparer. I've simplified this heavily. There's normally a large section for declaring dependents (nonworking spouse and children under 17, or an adult child, significant other, or family member (or someone who lives with you for a full calendar year and you pay more than half of their living expenses.)). The deductions that come with having a dependent, or multiple dependents, are very complex and above my pay-grade right now. I think all the papers I've implemented is already a clunky system. Of course this means this doesn't function as a fully educational simulation of American taxes. I've however kept all of the parts of my taxes that I have to fill out, so that this can be helpful to people like me (Single, no dependents, only once source of income that pays with a w2. I also hope to acknowledge paying taxes with a form 1099 and business deductions.) But if you're like me you pay your taxes as soon as you get the W2 and you use turbo tax so that you can forget about it for another 12 months.

OH BOY WAS THAT LONG. I'll save talking about the other forms for later I guess that was a lot of talk just about the 1040.

Lets talk about what I actually did today.

- Figured out the hard parts of programming that I didn't understand (The immediate roadblocks, not all of the hard parts.)

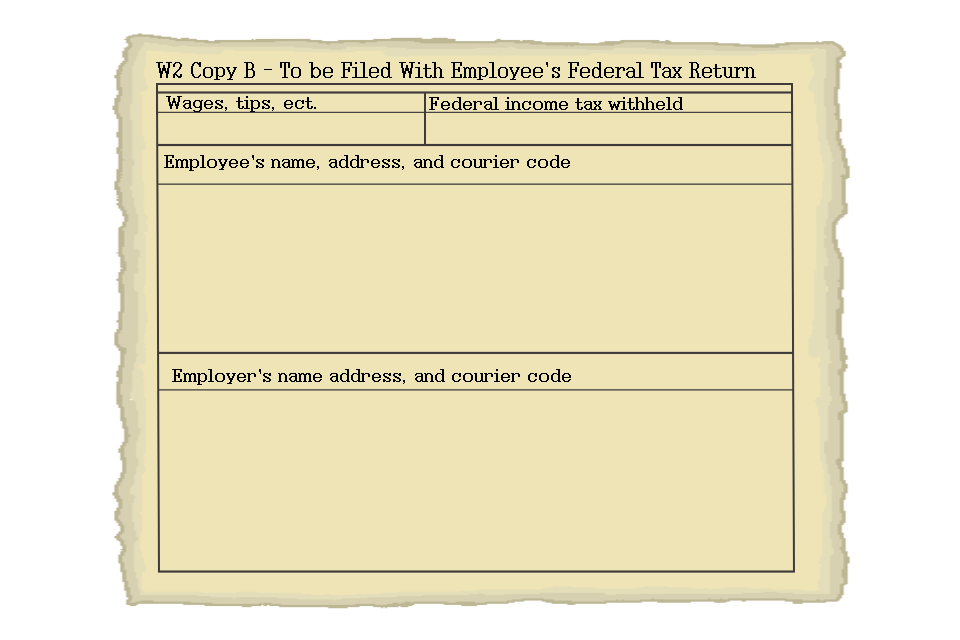

- Okay well i need to add in a W2 to get the information for the 1040 from

- Texture a W2 template and a temporary demo W2

- Time to make buttons that switch between the W2 and the Form 1040.

- Oh that was way easier than the text verification

- Have working buttons!

- Wow!

- Okay time to do some texture stuff I guess.

- Lets make a background so its not just a paper on a gray screen!

- I used this plank texture from Open Game Art and scaled it and tiled it to make a background! This is hopefully a temporary asset so I'm not gonna post the full resolution of it but you'll see it.

- On the subject of art LordAcies (on itch.io) is helping with asset and background art! I'd say we've got a pretty packed team here now, but theoretically this means we can get more done? (I'm not going to expand goals/scope though.)

- Time for more tax reading!

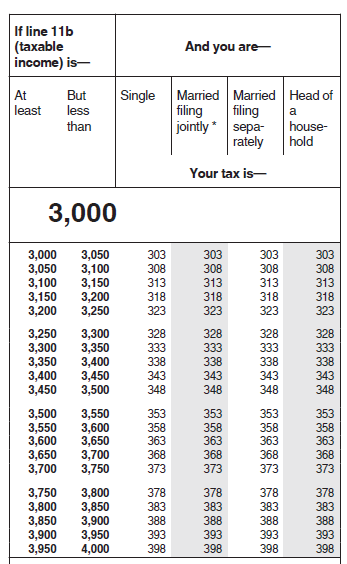

- You can see the form1040 references a tax table. This is the part of the instructions for the form 1040 that is the actual calculation for the amount of tax you need to pay. It goes from 0 to 99,999, any income over that and there is a tax worksheet to work through. so I had to simplify this table.

- Simplyfying this table sucks. It is incredibly long as the amount of tax you pay changes at $50 increments. Look at it:

- That's just one of the sections. Again it goes up to $99,999.

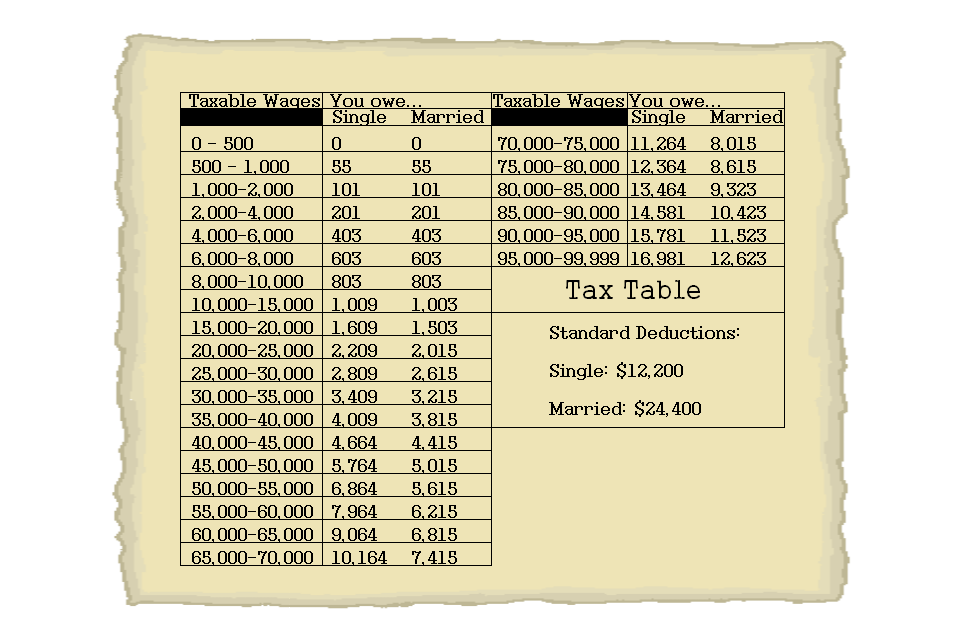

- So I had to simplify it HARD.

- What I ended up doing was simple i started out with smaller ranges at first (0-500, 500-1000,1000-2000,ect.) until i got to 10,000. At 10,000 i ended ranges every 5,000. I think it worked pretty well!

- I also included the standard deductions on the tax table because normally those are on the form 1040 next to the MANY lines used for calculating your AGI (Adjusted Gross Income.) My simplified 1040 doesn't have all those lines or space. So I put them on the tax table.

- Okay great another paper that means more buttons.

- So I get some more buttons working.

- And now it looks like this:

- Wow! Gyazo doesn't let me record long enough to show off the text boxes and the bad popup that shows up when they don't contain the correct information. But that happens I promise.

So that's day four! Now I have some planning to include in the bottom of this so that I don't forget what I'm doing. Because i keep forgetting to take notes and it's slowing down my workflow.

To do:

- Figure out a transition shader so that its not such a harsh flip back and forth. I've got a video tutorial open right now.

- Once the dialogue system is finished, get that from Speck and add it in.

- Gotta talk to my team about character art and writing for the first scenario tutorial thing that teaches you to pay taxes with a W2.

- Research 1099 forms more

- Make some smaller paper textures for receipts and invoices.

- make a 1099 template

- Figure out how to handle receipts an invoices for itemized deductions.