Hello !

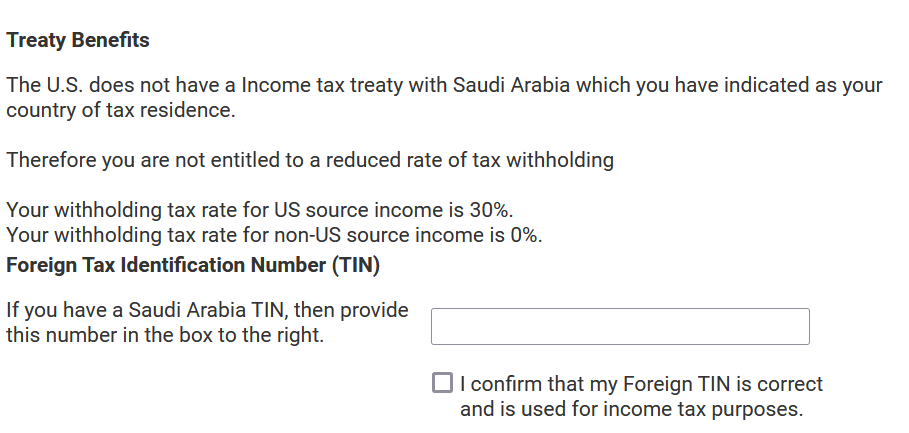

I am finishing my tax interview, and I got to this part where it says, it takes 30% tax rate.

Can someone please explain to me this, so if I live in Saudi Arabia, and if I withdraw my money from my itch.io account.

I will lose 30% of my total Available Balance ?

So if my balance is $100, I will get $70 only ?

Thank you in advance :)